Fans claimed they had lost their entire life savings in less than the amount of time it takes to watch an episode of The Simpsons, as Haliey Welch and the creators behind her ‘$HAWK token’ have been accused of coordinating a ‘rug pull’.

The term is used to describe the process where creators of cryptocurrency sell off their stock, leading to prices crashing, and those who put money into it are left with coins worth next to nothing.

The value of Welch’s cryptocurrency plummeted from as much as $490 million to just $41 million – with some news outlets even claiming it lost more than 95 percent of its value in the one day it was released, on December 4.

Now, those investors who were left out of pocket have hired lawyers to go after Welch and the team behind her.

In a document that was filed to the court yesterday (December 19), it read in part that the lawsuit ‘arises from the unlawful promotion and sale of the Hawk Tuah cryptocurrency memecoin, known as the “$HAWK” token (the “Token” or “$HAWK”), which Defendants offered and sold to the public without proper registration’.

Haliey Welch appearing on SiriusXM back in July (Michael Tullberg/Getty Images)

Tuah The Moon Foundation, which oversaw the memecoin’s finances, OverHere Ltd, which created the coin, and Clinton So, executive at OverHere, have all been named in the lawsuit alongside the coin’s promoter Alex Larson Schultz.

However, Welch was not named in the complaint which alleges that the defendants used her social media following to market the coin to ’emphasize community engagement, inclusivity, and bridge mainstream culture with the cryptocurrency world‘.

Although Reddit users are skeptical and seemingly believe that she could still be dragged into the court case.

Taking to the platform, one person commented: “She’s gonna be the scapegoat for the others involved.”

Welch has not been named in the lawsuit against the team behind her memecoin (Instagram/hay_welch)

“She tried to make easy money without knowing or caring how it worked. She knew they were using her name / popularity to promote so that’s all on her,” a second said.

“Not saying the others involved shouldn’t get sued too, but she’s not an innocent scapegoat.”

Another replied: “Of course she was trying to make money. But at the same time, she could’ve been lied to about how things will work.

“Even all of us here know s*** about f***, so imagine how clueless the average person is on crypto. Not saying she’s innocent about the scam part, but it’s possible.”

Welch, who went viral earlier this year with her now-infamous response to the question of ‘what makes a guy go crazy in bed?’, launched her cryptocurrency named HAWK on December 4.

Speaking about the release in an interview with Fortune, Welch’s manager, Jonnie Forster, said they were ‘tokenizing, in a sense, Haliey’s fan base’.

Haliey Welch launched a podcast after going viral (Michael Tullberg/Getty Images)

Following its launch on Wednesday, the HAWK coin quickly hit a market capitalization of nearly $500 million, according to Forbes. But within 20 minutes, the coin’s value completely tanked and plummeted from as much as $490 million to just $41 million.

The sudden tank caused a flood of backlash from Welch’s fans, with one person calling her out as they wrote: “I am a huge fan of Hawk Tuah but you took my life savings. I purchased your coin $Hawk that you were so excited about with my life savings and children’s college education fund as well.”

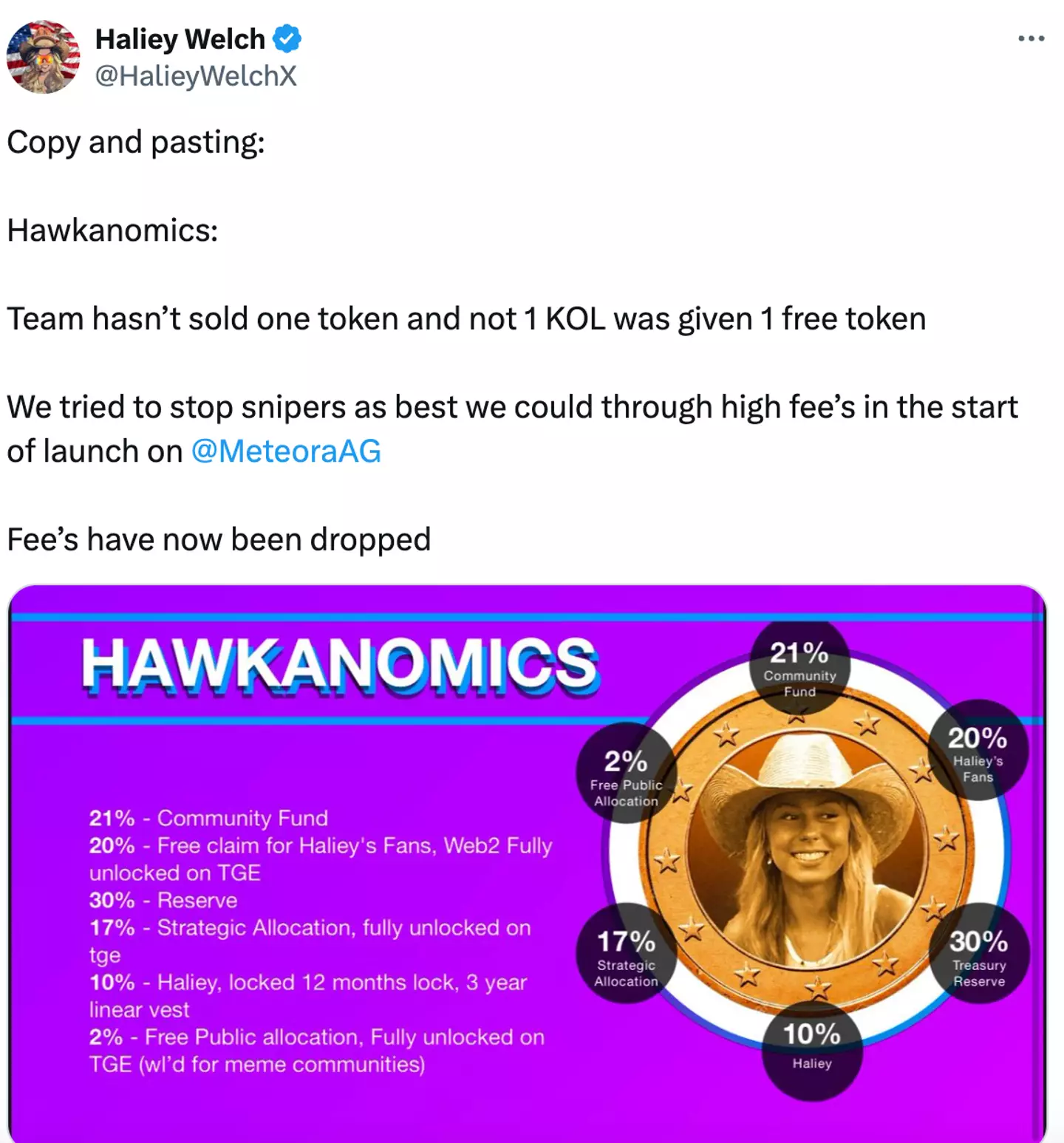

Welch stood by the launch in the chaotic aftermath, sharing a copied post on Twitter which read: “Hawkanomics: Team hasn’t sold one token and not 1 KOL was given 1 free token. We tried to stop snipers as best we could through high fee’s in the start of launch on @MeteoraAG. Fee’s [sic] have now been dropped.”

Welch appeared to defend the crypto in a post after its launch (X/@HalieyWelchX)

But investors are still fuming over what has been described as a ‘rug pull’; a situation in which crypto creators sell off their stock, leading to prices crashing.

As a result, at least one law firm in the US is encouraging investors to get in touch to see whether they might have grounds for a lawsuit.

Burwick Law, which is located in New York, says it ‘stands with investors who’ve been burned by abandoned celebrity-backed NFT projects and tokens’.

Burwick Law encouraged HAWK investors to get in touch (X/@BurwickLaw)

“While everyday people take losses, celebrities walk away richer. We’re here to help bring accountability to a space that desperately needs it,” the firm said in a post on Twitter.

It addressed investors of Welch’s coin in another post, writing: “If you lost money on $HAWK, contact our firm to learn about your legal rights. Our firm represents thousands of nft and token investors in securities matters.”

When Welch launched her coin, she told Fortune it was ‘not just a cash grab’, and that she was genuinely interested in using crypto as a way to connect with her fans.